Insurance and the carbon removal conundrum

It is COP27, and as expected, the talk is around climate action, inaction and how to drive more action.

At Kita, we speak with companies all the time regarding how they can drive net zero ambitions at speed, and how our Carbon Purchase Protection Cover can enable this. In one of these discussions recently, the Head of Sustainability at a large company said - “you’re helping me solve a chain of problems that my Board doesn’t know exist”.

This comment hit home, highlighting the layers of confusion and complexity when it comes to executing high integrity, secure net zero strategies. As COP27 focuses minds on creating climate impact at speed, let’s consider some of these layers and how we can unravel them.

PROBLEM #1: Understanding the different types of carbon credits

The goal of any net zero strategy should be to eliminate and reduce emissions. Offsetting is the final action, applied to emissions which are truly unavoidable.

Given the monumental task we face to decarbonise at scale, it is essential to confront the need for offsets and to ensure that they are of the highest possible quality. But what does this mean?

The carbon credits integrated into a high integrity net zero strategy should:

Be based on a portfolio approach, to diversify impact and reach;

Be consistent with developing best practices standards (e.g. science-based targets, Core Carbon Principles, Oxford principles); and

Include high integrity carbon removal credits (our emphasis)

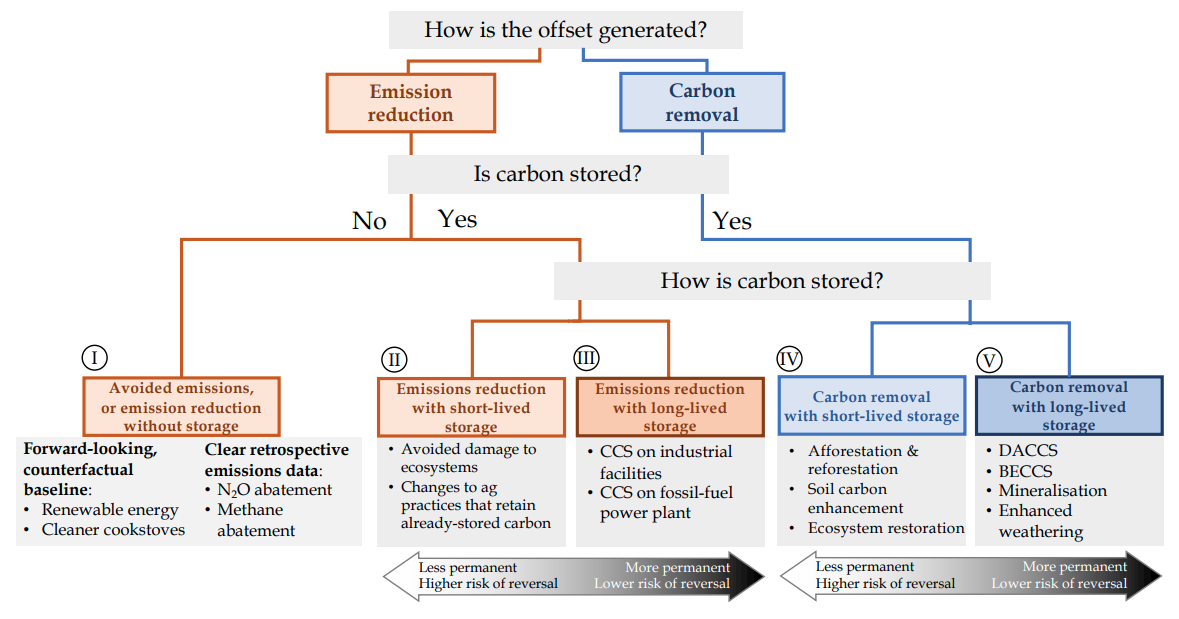

That third point is key: there are many types of carbon credits and a lot of confusion around the distinctions, including between carbon avoidance credits and carbon removal credits. Experts in the field have outlined this variation in great depth, but a simple visualisation from the Oxford Principles for Net Zero Aligned Carbon Offsetting looks like this:

Kita’s Carbon Purchase Protection Cover is focused solely on carbon removal credits - both nature-based (e.g. afforestation) and engineered (e.g. biochar). Why? According to the IPCC (Intergovernmental Panel on Climate Change), we’ll need to remove 10 billion tons of CO2 from the atmosphere by 2050. Kita sees the carbon removal sector as pivotal in addressing the climate crisis.

So we’ve looked at problem #1 and we have a clearer understanding of carbon removal credits and their importance as part of a diversified carbon portfolio...but this leads to the next quandary...

PROBLEM #2 – LACK OF CARBON REMOVAL CREDIT SUPPLY

We know we need to invest in carbon removal credits but, remarkably, at present they only account for ~10% of the carbon market! See our blog on this here, stemming from BeZero’s report - “Removal Reconsidered”.

Carbon removal is the new kid on the carbon block and needs significant financing to scale at speed (alongside, of course, improved measuring, reporting and verification to standardise quality and performance).

Carbon removal is expected to grow significantly – as BeZero points out, it should grow to almost 60% of the voluntary carbon market by 2030.

For now however, this shortage of supply combined with projected rising prices means that companies are increasingly considering their net zero strategies from a strategic perspective – acting now to start building a carbon removal portfolio for the future; locking in both supply and price.

The result is a rise in forward-purchasing of carbon removal credits. According to the Ecosystem Marketplace, forward purchases increased 65% in 2021. But herein lies the central problem:

PROBLEM #3 – FORWARD PURCHASES HAVE CARBON DELIVERY RISK BECAUSE CARBON REMOVAL TAKES TIME

We’ve explored the need for greater understanding around types of carbon credits and we’ve acknowledged that carbon removal credits are required to meet high integrity net zero targets. We’ve covered the lack of supply leading to forward purchases. Now for the final kicker – timeframes and delivery risk.

Carbon removal takes time. New technologies need time to scale up. Nature needs time to grow and restore.

Forward purchases can finance carbon removal projects years before a verified carbon credit is ready to be retired against a net zero claim.

This introduces a key problem – there is a risk that the carbon promised won’t be delivered. Nature-based and engineered carbon removals carry specific risks in this regard:

"Nature-based" carbon removals, e.g. forestry, mangroves

bring social and biodiversity benefits alongside carbon impact

price is currently low but expected to rise significantly

nature carries uncertainty: for example fire, wind, drought

Fraud and negligence can be a concern

"Engineered" carbon removals, e.g. biochar, direct air capture, advanced weathering

permanence at higher cost

often rely on recently developed machinery and novel processes

newly developed technology may not perform as expected

start-ups dominate this landscape with their associated solvency risks

THE CURRENT LANDSCAPE – BETWEEN A ROCK AND A HARD PLACE

So where does this leave companies that are trying to develop an effective, secure net zero strategy?

Between a rock and a hard place.

The rock: high integrity net zero targets necessitate carbon removal purchases. To lock in supply now for those future targets, pre-purchasing is required. This causes delivery risk. Many corporate buyers quite logically are not willing to take on this risk, particularly in the voluntary carbon market where a lack of transparency and consistent risk management can lead to greenwashing accusations.

The hard place: if corporates don’t start building a carbon removal portfolio, they run the serious risk of missing net zero targets and facing increasing scrutiny via disclosures such as TCFD. Another greenwashing risk.

Furthermore, and most pressing, if companies do not invest heavily in high-quality carbon removal credits, this will have a profound and devastating impact on the planet.

THE SOLUTION

Fear not, we didn’t write this whole post to leave a lasting message of doom and gloom. In fact, we’re confident and positive about the future of carbon removal. We are lucky to speak regularly to passionate founders, engineers, academics and scientists about the incredible progress being made in the carbon removal sector. We get to hear about technologies and processes that have the potential to be transformational in their scale and impact.

But in the meantime, Kita sees the current challenges in the market and we have created a solution – Carbon Purchase Protection Cover. For all the problems outlined above, we believe that insurance has the potential to offer solutions. And we’re not alone: a key takeaway from McKinsey’s Green Business Building Summit in September was:

“We will need trillions of dollars in investment to get [carbon removal] projects built at the pace we need. Investors are showing strong interest, but we need to find ways to widen the pool and reduce the debt risk profile for project financiers, including through...innovative use of insurance.”

Kita’s Carbon Purchase Protection Cover protects buyers of carbon removal credits against carbon delivery risk by insuring carbon removal credit forward purchases.

Kita helps de-risk carbon removal purchases by:

providing additional due diligence and fraud checks

serving as an independent quality assessment

enabling a lower cost of capital

increasing internal rates of return

providing budget certainty for carbon purchasing

reducing carbon market price risk

If your carbon removal credits underperform, Kita covers your loss.

What does this mean for corporate buyers of carbon removal credits?

You can lock in preferred pricing and secure supply, safeguarding climate commitments

You can be confident on your TCFD disclosures that you’ve put in place strong due diligence and risk management

You can reduce the risk on your balance sheet overall via insuring your purchase

In a rapidly moving climate change-focused environment – social, regulatory, liability – you can gain a competitive advantage with confidence

In the field of carbon removal purchases, Kita enables more companies to be early movers by taking away the early mover risk.

WHY DOES THIS MATTER?

As long as this risk sits on balance sheets, carbon removal credit purchases will inhabit the “niche purchase” category in company books. To gain the rapid scaling the world needs to fight the climate crisis – IPCC estimates that 10 gigatons of carbon removal is required annually by 2050; today, we are at just 0.003 Gt – we can’t rely on niche purchases. We need to move to purchasing at scale.

This is not realistic without the safety net that insurance provides.

We started this blog with a quote from a client. Let’s end with another one, this time the Head of Environmental Products at a large carbon financer: “The next stage of removal can't be funded by balance sheets. We don't have enough balance sheet."

By providing Carbon Purchase Protection Cover, Kita intends to help get carbon removal credit forward purchase risk off the balance sheet, enabling more corporates to access the carbon removal credit market – securing their high integrity net zero strategies without high risk, while also scaling carbon removal solutions to meet the world needs.

WANT TO TALK PRODUCT SPECIFICS?

What exactly does our Carbon Purchase Protection Cover insure you against? How does it work? When can you buy it?

For all these questions and more, please get in touch.